Introduction

Definition of Real Estate Insurance

Real estate insurance is designed to protect property owners from various unforeseen circumstances that could lead to financial losses. This type of insurance covers various properties, including residential homes, commercial buildings, and rental units. It typically provides coverage for:

- Property damage: Protects against natural disasters, accidents, or vandalism.

- Liability: Covers injuries that may occur on the property.

- Loss of income: Compensates for rental income lost due to property damage.

Significance of Real Estate Insurance for Property Owners

For any property owner, having the right insurance is paramount. When you consider the financial implications of unexpected events, it becomes clear that real estate insurance isn’t just a safety net—it’s an essential tool for peace of mind.

Imagine facing a sudden flood that damages your rental properties. Without adequate coverage, recovering from such losses could be an uphill battle. By securing a landlord insurance policy, property owners can safeguard their investments and ensure stability in uncertain times.

Types of Real Estate Insurance Coverage

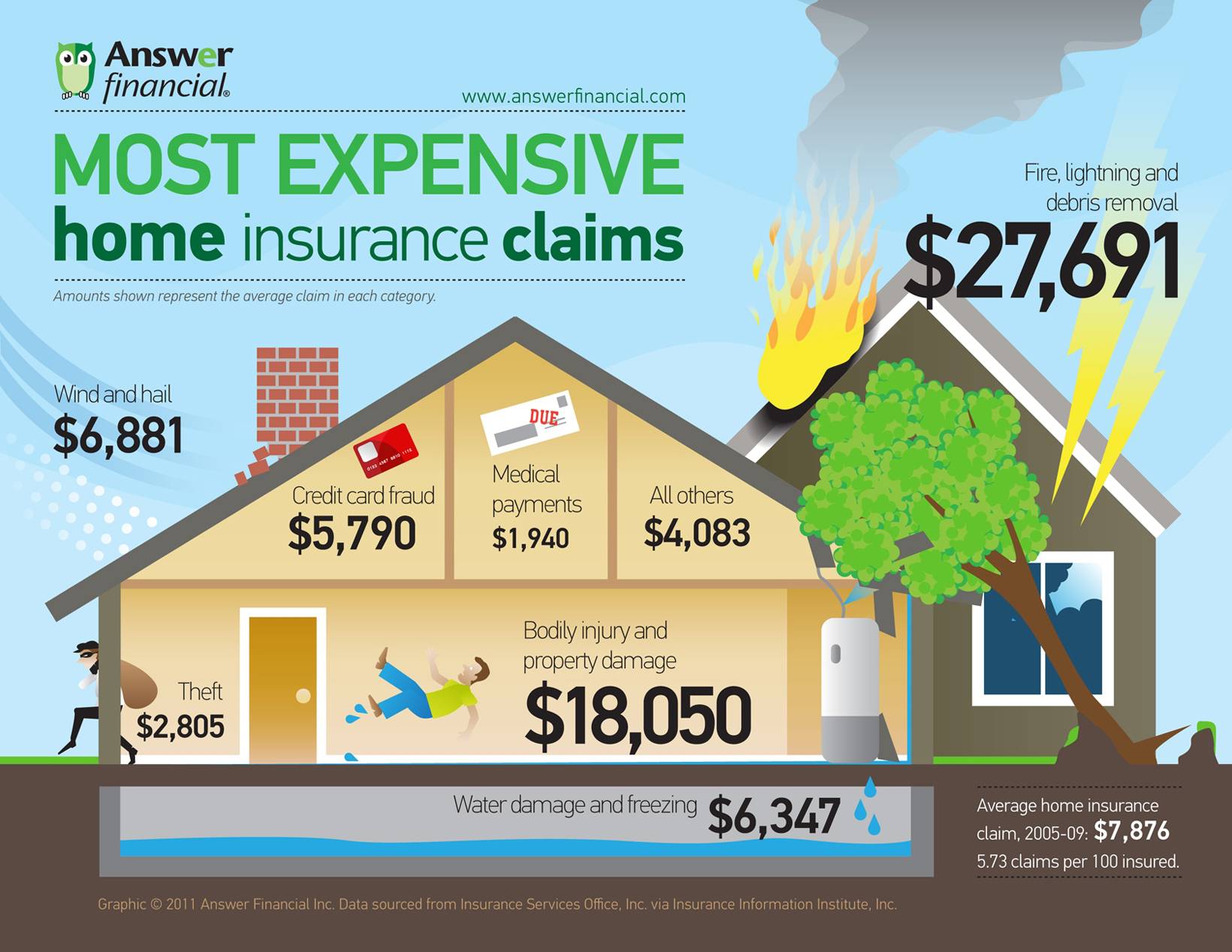

Property Damage Coverage

Property damage coverage is your first line of defense when disaster strikes. Whether it’s a fire, storm, or vandalism, this coverage ensures that you won’t have to bear the costs of repairs alone.

- Common events covered: Natural disasters, theft, and accidental damage.

- Why it’s essential: Think about the financial burden of repairing a roof after a heavy storm. Without this coverage, it could lead to significant out-of-pocket expenses.

Liability Coverage

Next up is liability coverage, which protects you if someone gets injured on your property. For example, if a tenant slips on a wet floor and decides to sue, liability coverage steps in to cover legal costs and settlements.

- Key benefits: Helps pay medical bills and legal fees.

- Real-life example: Consider a scenario where a guest trips and injures themselves; without liability coverage, your savings could be at risk.

Business Interruption Coverage

Lastly, business interruption coverage is crucial for landlords and commercial property owners. It compensates for lost income during periods when your property can’t be rented out due to damage.

- Protection during downtime: This includes costs like mortgage payments or other fixed expenses.

- Real-world application: Imagine dealing with a flooded property that takes months to restore. Without this coverage, your financial stability could be severely compromised.

In summary, understanding these key types of coverage can help you choose the right insurance policy and protect your investments effectively.

Reasons Why Property Owners Need Real Estate Insurance

Protection Against Natural Disasters

As a property owner, the thought of a natural disaster can be daunting. From hurricanes to wildfires, these events can devastate your investment. Real estate insurance is your safety net that helps cover costly repairs and rebuilding efforts.

- Example: Imagine a storm causing extensive roof damage. Without insurance, you’d shoulder the entire repair cost, which can be overwhelming.

Safeguarding Against Lawsuits

Another crucial reason for obtaining real estate insurance is the protection it offers against lawsuits. If a tenant, guest, or even a bystander is injured on your property, you could be held liable for their medical expenses and other damages.

- Key aspect: Liability coverage ensures that legal fees and settlement costs don’t deplete your finances.

- Personal anecdote: A neighbor had to deal with a slip-and-fall case that went to court. Luckily, their liability coverage protected them from financial ruin.

Ensuring Financial Security

Lastly, real estate insurance provides reassurance that your financial future is secure.

- Protecting your investment: It allows you to focus on your investments and tenants without constant worry about unforeseen expenses.

- Long-term stability: With the right coverage, you can confidently weather the storms—literally and financially—knowing that your property is protected.

In conclusion, having real estate insurance not only shields you from risks but also promotes peace of mind, helping you focus on what truly matters.

How to Choose the Right Real Estate Insurance Policy

Assessing Property Value and Risks

Choosing the right real estate insurance policy begins with assessing your property’s value and the risks involved. This step is crucial because underestimating either can lead to inadequate coverage.

- Property evaluation: Consider factors like location, age, and condition. For example, if you own a beachfront property, storms and flooding may pose significant risks.

- Conduct a risk assessment: Identify what disasters could affect you—either natural events or man-made threats, like vandalism.

Comparing Insurance Quotes

Once you have a solid understanding of your property’s needs, it’s time to compare insurance quotes.

- Gather multiple quotes: Reach out to different insurers to get a variety of options, ensuring you understand the coverage provided.

- Personal tip: I found that comparing quotes helped me save hundreds of dollars while ensuring I received comprehensive coverage.

Understanding Policy Exclusions and Inclusions

Finally, delve into the nitty-gritty of your policy by understanding inclusions and exclusions.

- Read the fine print: Make sure that you are clear on what is covered, as well as what isn’t. For instance, some policies might exclude flood insurance, which is essential if your property is in a flood zone.

- Ask questions: If anything seems unclear, don’t hesitate to reach out to insurance agents for clarification.

By following these steps, you can confidently select a real estate insurance policy tailored to your needs, ensuring that you’re well-protected.

Common Mistakes to Avoid When Purchasing Real Estate Insurance

Underinsuring the Property

One of the most critical mistakes property owners make is underinsuring their property. If you estimate your property’s value too low, you risk facing enormous financial strain in case of a major incident.

- Consider replacement costs: Factors like renovations or market trends can increase your property’s value over time. It’s essential to have coverage that reflects the current market conditions.

- Personal reflection: I learned this lesson the hard way when my friend had to make significant out-of-pocket expenses after a fire because their coverage didn’t match the actual repair costs.

Neglecting Liability Coverage

Another common pitfall is neglecting liability coverage. This can leave you vulnerable if someone suffers injuries on your property.

- Remember the ‘what ifs’: Just think about a guest falling on a slippery floor during a rainy day. Without adequate liability coverage, you could end up facing hefty legal bills.

- Real-life scenario: A neighbor of mine didn’t have sufficient liability coverage, and it cost them dearly when a visitor was injured.

Overlooking Additional Coverage Options

Lastly, many property owners overlook vital additional coverage options.

- Flood and earthquake coverage: These policies might not fall under standard insurance but are crucial for specific regions.

- Anecdote: I once spoke with a landlord who wished they had considered flood insurance after a surprise storm caused significant damage. They had to bear repair costs all due to a lack of foresight.

Avoiding these common mistakes can empower you to choose the right real estate insurance policy, ensuring financial security and peace of mind.

Real-Life Examples of Real Estate Insurance Benefits

Case Study: Property Damage Coverage in Action

Let’s take a look at a real-life example demonstrating the benefits of property damage coverage. A friend of mine, Sarah, experienced a devastating house fire that destroyed part of her rental unit. Thanks to her comprehensive property insurance, she was able to cover the repair costs without significantly impacting her finances.

- Quick response: The insurance company worked fast, enabling her to restore the property and minimize the time it was vacant.

- Key takeaway: Having insurance in place allowed Sarah to focus on rebuilding her property and her confidence without the burden of financial stress.

Case Study: Liability Insurance Saving the Day

Next, consider the story of Mark, a landlord who faced a lawsuit when a tenant slipped and fell in the common area of his apartment building. Fortunately, Mark had liability coverage that stepped in to cover legal expenses and medical bills.

- Lowered financial burden: This coverage saved him thousands of dollars, allowing him to maintain his peace of mind.

- Real benefit: Mark learned that being proactive about liability insurance wasn’t just about protecting his wallet; it was about safeguarding his reputation as a responsible landlord.

These examples illustrate that real estate insurance isn’t just a requirement; it’s an essential tool to protect your investments and ensure your peace of mind in tumultuous times.