Understanding Economic Cycles and Real Estate Markets

Definition and Explanation of Economic Cycles

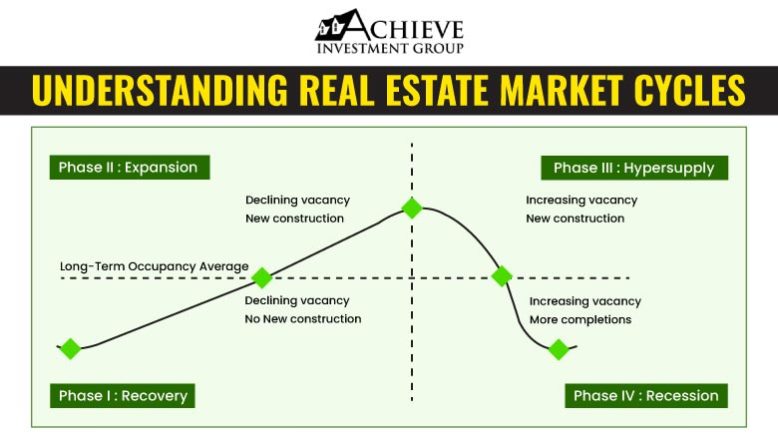

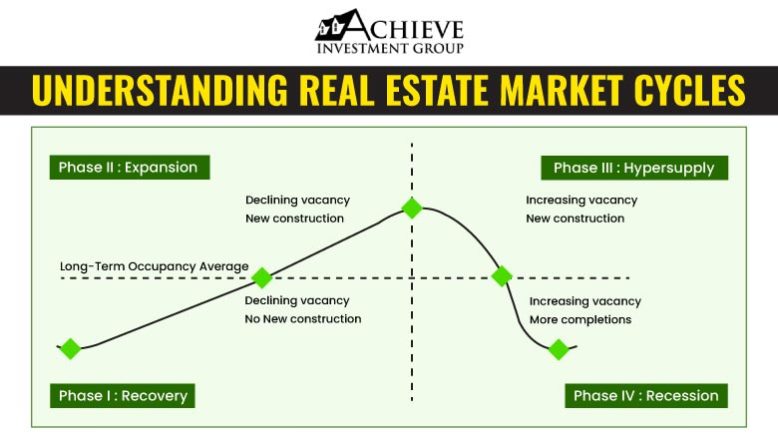

Economic cycles consist of distinct fluctuations in economic activity over time. These cycles typically include four major phases:

- Expansion: Characterized by increased economic growth, rising GDP, and improved employment rates.

- Peak: The economy reaches its maximum potential, often leading to inflation.

- Recession: A decline in economic activity marked by reduced consumer spending and job losses.

- Recovery: The economy slowly rebounds from recession, setting the stage for another expansion phase.

These cycles can have profound effects on various sectors, particularly the real estate market. As conditions change, property values and investment opportunities follow suit.

Introduction to Real Estate Markets

Real estate markets are inherently intertwined with economic cycles. They respond to shifts in the economy with adjustments in both property prices and demand.

Here are some key elements to consider:

- Supply and Demand Dynamics: In an expanding economy, demand for housing often soars, driving prices up. Conversely, during recessions, the demand may dwindle, leading to price drops.

- Diverse Types: The real estate market comprises residential, commercial, and industrial sectors, each reacting differently to economic conditions.

For example, during the last economic recovery following the 2008 financial crisis, home values in many regions surged, showcasing how recovery phases can offer lucrative opportunities for investors. Understanding these cycles is essential for making informed real estate investments.

The Relationship Between Economic Cycles and Real Estate

Impact of Expansion Phase on Real Estate

During the expansion phase of the economic cycle, the real estate market often experiences a surge in activity. Increased consumer confidence and rising employment rates lead to:

- Higher Property Values: As demand for homes escalates, prices naturally rise, making it an excellent time for property owners to sell.

- New Developments: Builders seize opportunities to start new residential and commercial projects, anticipating continued growth.

- Increased Mortgages: Buyers are more likely to finance homes due to favorable interest rates, leading to higher sales volumes.

For example, during the late 1990s tech boom, cities like San Francisco witnessed a significant uptick in property prices driven by incoming tech professionals.

Effects of Recession Phase on Real Estate

Conversely, the recession phase can be harsh on the real estate sector. Economic pessimism often leads to:

- Decreased Demand: Many potential homebuyers withdraw from the market due to job losses and uncertainty.

- Falling Prices: Increased inventory levels coupled with reduced demand can cause property values to plummet, resulting in negative equity for many homeowners.

- Foreclosures: Unfortunately, financial strain can lead to higher foreclosure rates, further depressing the market.

Influence of Recovery and Boom Phases on Real Estate

As the economy begins to recover, the real estate market shows signs of revitalization. The boom phase can be characterized by:

- Rising Sales: With improved consumer sentiment, homebuyer interest returns, often fuelled by low-interest rates.

- Investment Opportunities: Investors flock to the market looking for undervalued properties to capitalize on upcoming growth.

- Stabilizing Prices: As demand starts to outpace supply, property values begin to recover, creating a potential for capital appreciation.

In this way, the interplay between economic cycles and real estate not only influences markets but provides valuable insights for savvy investors. Understanding these relationships can ultimately lead to strategic, timely decisions in property investment.

Factors Influencing Real Estate Performance During Economic Cycles

Interest Rates and Mortgage Market

One of the most significant factors influencing real estate performance during economic cycles is the prevailing interest rates. These rates affect the mortgage market, which in turn shapes homebuying behavior.

- Lower Interest Rates: When the economy is expanding, central banks often lower interest rates to encourage borrowing, making mortgages more affordable. For example, many buyers flock to the market when rates drop to record lows, boosting sales and driving up property prices.

- Higher Interest Rates: Conversely, during economic uncertainty or inflation, rates may rise, leading potential buyers to hesitate. This can slow down transactions and reduce overall market activity.

Consumer Confidence and Spending Habits

Consumer confidence plays a crucial role in real estate dynamics. When consumers feel optimistic:

- Increased Home Purchases: Confidence leads to more homebuyers entering the market, which pushes demand higher.

- Higher Spending: A willingness to spend can lead to upgrades and renovations, driving up property values.

However, during economic downturns, consumer sentiments can plummet, resulting in:

- Deferred Purchases: Buyers may delay decisions, waiting for more favorable conditions before investing in real estate.

Employment Rates and Job Opportunities

Employment rates greatly impact real estate performance. A robust job market typically correlates with a thriving housing market, as:

- Increased Income Levels: When people are employed, they have more disposable income to invest in homes, whether it’s their first purchase or an investment property.

- Population Growth: New job opportunities attract people to areas, causing spikes in demand for housing in those regions.

However, during recessions, high unemployment rates lead to:

- Increased Foreclosures: Financial strains can result in more homeowners defaulting on mortgages, further affecting property prices.

These factors collectively create a complex web of influences that dictate real estate performance throughout various economic cycles, underscoring the need for investors to stay informed and adaptable.

Strategies for Real Estate Investors in Different Economic Phases

Investing in Expansion Phase

Navigating the expansion phase of economic cycles presents numerous opportunities for real estate investors. During this phase, demand for housing and commercial properties typically soars, making it a prime time to invest. Here are some effective strategies:

- Buy Early: Identify emerging neighborhoods before they become trendy. Investing early can lead to significant appreciation in property value.

- Focus on Development: Consider new construction projects. As demand grows, residential and commercial developments can yield high returns.

For instance, an investor who purchased a condominium in a revitalizing area during the early stages of an expansion could see notable gains as prices rise.

Adapting Strategies During a Recession

A recession can be unsettling, but with the right strategies, investors can pivot effectively. Key approaches include:

- Look for Bargains: Identify foreclosures or distressed properties available at a discount. These can be excellent long-term investments.

- Focus on Rentals: Consider transitioning into the rental market. During economic hardships, families often prefer renting over buying, which can lead to stable cash flow.

Utilizing these tactics can help investors weather the storm while capitalizing on lower property prices.

Maximizing Opportunities in Recovery and Boom Phases

As the economy begins its recovery and enters a boom phase, investors should seize the moment. Here’s how:

- Diversify Your Portfolio: Consider expanding into different real estate sub-markets, such as commercial properties or emerging markets that show growth potential.

- Leverage Financing: With interest rates still generally favorable, take advantage of financing options to amplify your buying power.

For example, an investor who expands their portfolio during a boom can ride the crest of increasing property values and rental demand, ensuring significant long-term gains. By strategically adjusting tactics throughout economic phases, investors can position themselves for success.

Case Studies and Examples

Real-life Examples of Real Estate Market Behavior in Economic Cycles

Understanding the relationship between economic cycles and real estate can be greatly enhanced through real-life examples. These case studies shed light on how different phases impact market behavior.

- The 2008 Financial Crisis: One of the most notable examples comes from the 2008 recession. Many homeowners faced foreclosure, resulting in steep declines in property values across the United States. Cities like Las Vegas saw home prices plummet by more than 50%. Investors who were patient during this time capitalized by purchasing distressed properties at bottom-of-the-market prices, ultimately benefiting as the market recovered.

- San Francisco Tech Boom: In contrast, the expansion phase during the late 1990s tech boom in San Francisco provides a compelling example of real estate thriving. With an influx of tech workers, demand for housing surged, and property values skyrocketed. Investors who had the insight to buy in the early stages of this expansion saw tremendous returns as prices doubled or tripled over the decade.

- COVID-19 Pandemic Impact: The recent pandemic also exhibited unique real estate dynamics. Initially, during early lockdowns, the market slowed. However, as the economy adapted, remote work accelerated demand in suburban areas, prompting price increases once again.

These examples illustrate how recognizing economic cycles can offer invaluable insights, helping investors make informed decisions tailored to market conditions.

Risks and Challenges in Real Estate Investing During Economic Fluctuations

Market Volatility and Uncertainty

Investing in real estate during economic fluctuations can be fraught with risks, primarily due to market volatility and uncertainty. Rapid changes in the economy can lead to:

- Unpredictable Price Fluctuations: Properties may fluctuate in value, making it challenging for investors to know when to buy or sell.

- Changing Demand: Consumer behavior can shift dramatically during economic downturns, affecting rental rates and occupancy levels.

For example, during the early stages of the COVID-19 pandemic, many investors faced sudden demand decreases in certain property types, leading to uncertainties in cash flow.

Mitigating Risks in Downturns

While downturns can pose significant challenges, there are strategies to mitigate risks effectively:

- Diversification: Spreading investments across different property types (residential, commercial) or geographical areas can reduce exposure to market-specific downturns.

- Strong Financial Reserves: Maintaining adequate reserves can help investors weather tough times, ensuring they can manage expenses even in reduced income scenarios.

For instance, an investor with a well-diversified portfolio encountered lower impacts during the 2008 recession due to cash flow from stable properties.

Long-Term Strategies for Sustainable Investments

Sustainable real estate investments thrive on careful planning and long-term strategies. Some effective practices include:

- Focus on Quality Over Quantity: Investing in quality properties with strong fundamentals leads to better retention and appreciation in the long run.

- Regular Market Analysis: Continuously assessing market trends ensures that investors stay informed and can make timely decisions to adjust their strategies.

By embracing these strategies, real estate investors can navigate the choppy waters of economic fluctuations, building resilient and sustainable portfolios that stand the test of time.